4 Easy Facts About Pvm Accounting Shown

4 Easy Facts About Pvm Accounting Shown

Blog Article

The Ultimate Guide To Pvm Accounting

Table of ContentsEverything about Pvm AccountingThe Buzz on Pvm AccountingAn Unbiased View of Pvm AccountingPvm Accounting - An OverviewExcitement About Pvm AccountingPvm Accounting for BeginnersAll about Pvm Accounting

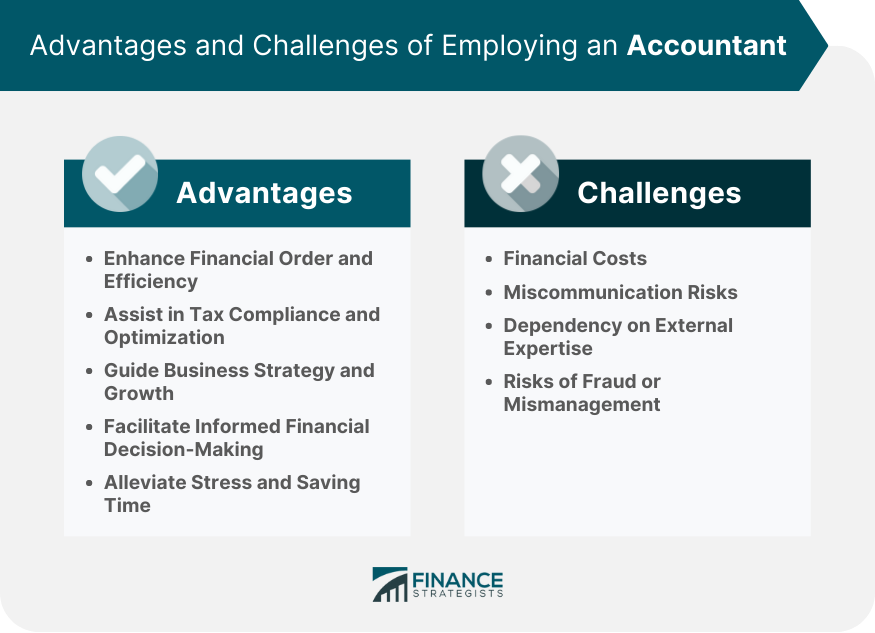

Is it time to hire an accountant? If you're an SMB, the right accountant can be your friend. At BILL, we have actually seen firsthand the transformative power that entrepreneurs and accountants can unlock with each other (construction taxes). From streamlining your tax obligation returns to examining funds for enhanced productivity, an accountant can make a huge distinction for your service.

This is a possibility to get understanding right into just how professional economic assistance can empower your decision-making procedure and establish your organization on a trajectory of continued success. Relying on the size of your organization, you might not require to work with an accountantat the very least, not a permanent one. Several little services employ the services of an accountant just throughout tax time.

Are spread sheets taking over more and even more of your time? Do you locate yourself annoyed tracking down invoices for expenses rather of focusing on work that's closer to your core objective?

Fascination About Pvm Accounting

An accounting professional, such as a cpa (CERTIFIED PUBLIC ACCOUNTANT), has actually specialized expertise in monetary administration and tax compliance. They stay up to date with ever-changing guidelines and best practices, making certain that your business stays in conformity with lawful and regulatory requirements. Their knowledge permits them to navigate complex monetary matters and offer accurate reliable advice customized to your specific business demands.

Do you frequently spend time on economic statement preparation instead of functioning on service administration? Financial resources can be time consuming, particularly for little service proprietors that are already juggling several duties.

3 Simple Techniques For Pvm Accounting

Accounting professionals can manage a selection of jobs, from accounting and monetary records to pay-roll processing, maximizing your schedule. When it pertains to making economic choices, having an accountant's recommendations can be extremely useful. They can provide financial evaluation, scenario modeling, and forecasting, enabling you to assess the possible effect of different choices prior to choosing.

How Pvm Accounting can Save You Time, Stress, and Money.

For those that don't currently have an accountant, it might be tough to know when to reach out to one. Every business is various, but if you are facing challenges in the complying with locations, now may be the right time to bring an accountant on board: You don't have to compose an organization strategy alone.

This will aid you produce a well-informed economic technique, and offer you extra self-confidence in your monetary choices (construction bookkeeping). Which legal structure will you choose for your organization.?.!? Working together with an accountant makes sure that you'll make educated decisions about your company's legal structureincluding comprehending your options and the advantages and disadvantages of each

What Does Pvm Accounting Do?

Tiny company bookkeeping can end up being challenging find if you don't know exactly how to handle it. The good news is, an accounting professional knows exactly how to track your financial resources in a variety of helpful methods, consisting of: Establishing bookkeeping systems and arranging economic documents with help from accounting software program. Aiding with cash circulation administration and providing understandings into income and expenses.

Analyzing costs and suggesting ways to produce and adhere to budget plans. Providing analysis and reporting for educated decision making. Maintaining you prepared for your income tax return all year long. Assisting you with the month-end close. Maintaining a digital paper path for thorough document keeping. This is most likely the most common reason that a tiny to midsize company would employ an accountant.

Pvm Accounting - The Facts

By working with an accountant, services can reinforce their funding applications by providing more precise financial info and making a much better instance for monetary stability. Accountants can also assist with jobs such as preparing monetary papers, evaluating financial information to examine credit reliability, and developing a thorough, well-structured financing proposal. When points transform in your organization, you wish to make sure you have a solid manage on your financial resources.

The Basic Principles Of Pvm Accounting

Are you prepared to sell your company? Accounting professionals can aid you determine your organization's value to help you protect a reasonable offer. In enhancement, they can help in preparing monetary statements and documents for potential purchasers. If you determine you await an accounting professional, there are a couple of straightforward steps you can require to ensure you locate the right fit.

Report this page